|

|

Post by Hoosier Hillbilly on Mar 9, 2011 15:26:39 GMT -5

I want to see some 'long term resolutions' for our current deficit situation and I want to see them now!

#"WE" can't wait any longer on Washington to do something!

* if they haven't got a plan to get "US" out of this mess ( THEY CAUSED! ) by the end of this year, it's time we joined the middle-east in a revolt!

(+) I'm serious, this has gone on long enough. This Nation is never going to make it if 'we' don't make plans now on what we're going to do!

No one wants to invest until there is some certainty in the market and a game plan for the future. This includes lowering the unemployment rate and stabilizing the economy. A forecast for the future would do this.

Our trade agreements, tariffs, and consumer agreements need to be looked @ closely and modified to fit our needs.

"WE" can no-longer afford to cater to foreign powers ( not from the US ) we must decide our own fate!

Be it [ fat or famine ] we have no choice!

It's now or never!

|

|

|

|

Post by indago on Jun 8, 2011 9:48:27 GMT -5

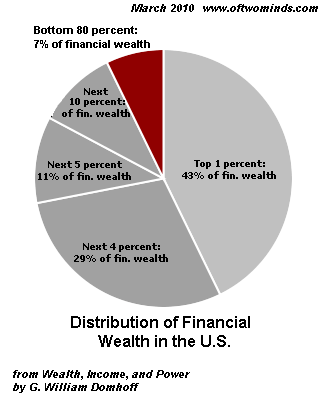

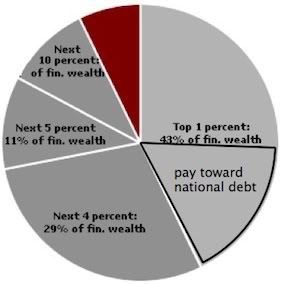

From AgentGenius 6 June 2011:articleThese "Cosmopolitan Financiers" just don't give a shit what they're doing. It's time to delve into paying into the National Debt on their backs, and shrink their stake in the wealth pie.  From The New York Times 18 August 2008: From The New York Times 18 August 2008:Chuck Raasch wrote for The Californian 9 April 2011: "Personal, shared sacrifice is only solution to debt woes". articleNO!Working folks have sacrificed enough. Over the past few years, working folks have sacrificed their jobs, their homes, their families, their life savings, etc. Wealth and their lobbyists, and congressional toadies, created this mess, let them clean it up. Working folks have paid enough already. Now, this wouldn't hurt so much...  ...and do it every year until the National Debt is paid off!

|

|

dent

Full Member

Account Suspended

Account Suspended

Posts: 232

|

Post by dent on Jun 8, 2011 22:02:42 GMT -5

That "pie chart" and article arte not really accurate. Simple fact is that the top 1% they reference pay most of the taxes paid into this country. The graph ignores the FACT that almost 50% of this country pay no taxes at all. It ignores the FACT that big companies pay no corporate taxes because they pay so much into helping people that by the time they get all their legitamate deductions, they owe no more. Ever watch "Extreme Makeover-Home Edition"? Ever notice how much Sears and CVS Pharmacy give to the people in that show? You can reduce your tax burden by giving money to charity, why can't they. Ever read how much the founder of Microsft gives to charity each year? Bill Gates is not stingy at all!!

This class warefare and redistribution of wealth crap is just pure Bovine Scatology. No one who ever had even Economics 101 would put any faith in that BS chart. Another thing, hate the rich all you want to, but when was the last time a poor man gave you a job. never bite the hand thaty feeds you. A little sense of gratitude is called for.

If you are not making it, it's not their fault, that all falls in YOUR lap.

|

|

|

|

Post by indago on Jun 9, 2011 7:13:52 GMT -5

The graph ignores the FACT that almost 50% of this country pay no taxes at all. That's impossible. You can't live in this country and not pay taxes. There are taxes embedded into just about everything you buy. articleThe federal income tax is an excise tax. Government was never granted the power to lay a direct tax upon the inhabitants of the States. |

|

|

|

Post by indago on Jun 9, 2011 10:37:34 GMT -5

Posted by Ed Harrison:

So, as you can see, to say that "almost 50% of this country pay no taxes at all" is absurd, at best.

|

|

Deleted

Deleted Member

Posts: 0

|

Post by Deleted on Jun 9, 2011 11:01:21 GMT -5

If the people want a long-term solution... Get rid of the IRS and replace income tax with a national sales tax with NO loop-holes or exceptions. www.fairtax.orgRead up on the Fair Tax and express your opinions. |

|

|

|

Post by indago on Jun 9, 2011 13:07:54 GMT -5

If the people want a long-term solution... Get rid of the IRS and replace income tax with a national sales tax with NO loop-holes or exceptions. www.fairtax.orgRead up on the Fair Tax and express your opinions. In discussions that I have had with those who are proponents of the FairTax, two items are in the forefront: Repeal the sixteenth amendment income tax, and eliminate the IRS. A tax structure is written into the Constitution of the United States, and, from this, there will always be a revenue collecting system. So, be it named IRS (Internal Revenue Service), RCS (Revenue Collecting System), or whatever, government will have a system by which the revenues will be collected, and it will not be gotten rid of. When the Constitutional tax structure was being constructed, during the Convention of 1787, there were two distinct categories of taxation developed: the direct taxes, and the indirect taxes, as described by the Supreme Court of the United States. The direct taxes, as were known at the time, were taxes upon the people, and their property. The indirect taxes were the excise taxes. Mr. Justice William R. Day, delivering the opinion of the United States Supreme Court, explained what an excise tax is: "Excises are "taxes laid upon the manufacture, sale, or consumption of commodities within the country, upon licenses to pursue certain occupations, and upon corporate privileges." "...the requirement to pay such taxes involves the exercise of privileges..." In the Congressional Record, it is noted, concerning direct taxes: "...the power granted to the federal Government to impose a direct tax was granted upon condition that the Government should estimate the amount of revenue it might require from that source and apportion the sum among the States on the basis of population as shown by the preceding census. This plan was intended to give the States the right to contribute their pro rata share from their own revenues without complicating their local systems of taxation. This was regarded as a matter of much importance to the States." During the construction of the direct tax system during the Convention, it was proposed that if the States did not ante up their share of the taxes, then the federal government would come into the State and collect the tax directly from the inhabitants of the State. This proposal failed. During the construction of the Bill of Rights, the same proposal was introduced in the House of Representatives: it failed again. When the House of Representatives sent their assemblage of the Bill of Rights to the Senate, the Senate also made the proposal, and it failed again. The Congress of the United States was never granted the power to lay a direct tax upon the inhabitants of the States. It was Alexander Hamilton who originally subverted the federal taxing system with his promotion of the carriage tax. He promoted that the tax be collected from the individual after the carriage was sold to him by the company. It was promoted as an excise tax. He promoted this tax while he was Secretary of the Treasury under George Washington. When he left office, he argued for the tax before the United States Supreme Court, and the Court was so enthralled with his oration that they found in his favor. This subversion was finally overturned 100 years later. Although the sixteenth amendment income tax was described by government before the Supreme Court of the United States as a new kind of tax, somewhere between the direct and indirect taxes, the Supreme Court declared that this was an "erroneous assumption". It was settled that the Congress never intended to breach the gap between the direct and indirect taxes, and that the income tax was in the excise tax category; that the sixteenth amendment created no new powers of taxation for government. As described in the Congressional Record: "The income tax is, therefore, not a tax on income as such. It is an excise tax with respect to certain activities and privileges which is measured by reference to the income which they produce. The income is not the subject of the tax: it is the basis for determining the amount of the tax." The fact that the Constitutional tax system has been subverted into what we have at present is testament to the gullibility of the inhabitants of the States. |

|