|

|

Post by Hoosier Hillbilly on May 25, 2011 6:14:12 GMT -5

GOLD

Randgold Resources Ltd 78.43

Close +2.75%

Today

|

|

|

|

Post by LuLu on May 26, 2011 11:38:44 GMT -5

Symbol__________Last__________Change

Dow Jones________12370.86_________-23.8

general electric_______36.96___________0.69

gold________________78.82__________-0.10

caterpillar___________15.92__________-0.33

|

|

|

|

Post by LuLu on May 27, 2011 12:16:12 GMT -5

Symbol__________Last __________Change

Dow Jones_________12461.60________58.84

general electric________37.50_________0.44

gold__________________81.43_________1.86

caterpillar_____________15.905_______-0.045

|

|

|

|

Post by LuLu on May 28, 2011 11:35:26 GMT -5

Symbol__________Last__________Change

Dow Jones________12441.58___________38.82

general electric_______37.40____________0.34

gold_________________81.18____________1.61

caterpillar____________15.93____________-0.02

|

|

|

|

Post by LuLu on May 31, 2011 14:37:44 GMT -5

Symbol__________Last__________Change

Dow Jones__________12504.63________63.05

general electric_________37.34________-0.06

gold__________________81.20_________0.09

caterpillar______________15.94________0.01

|

|

|

|

Post by LuLu on Jun 1, 2011 13:31:08 GMT -5

Symbol__________Last__________Change

Dow Jones_________12370.93_______-198.86

general electric________37.07_________-0.67

gold__________________81.86_________-0.10

caterpillar_____________16.00_________-0.02

|

|

|

|

Post by LuLu on Jun 2, 2011 13:13:56 GMT -5

Symbol__________Last__________Change

Dow Jones_________12257.97________-32.17

general electric________37.63__________0.70

gold__________________80.67_________0.04

caterpillar_____________15.62_________-0.34

|

|

|

|

Post by Hoosier Hillbilly on Jun 2, 2011 19:11:39 GMT -5

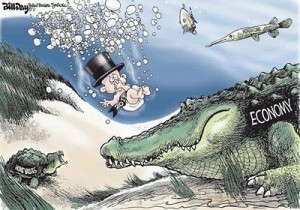

(In 'my' own opinion!), unless 'U'r into the market for more than 2 years, or until after the election my suggestion is look close ( and depending on what your invested in) consider cashing in on any profits or even getting out while you can break even. Nothing looks good @ the present, maybe mutual funds or bonds just to hold on to what you got cause the {dollar} is going to get worth less fast.

There's always value "there" but 'U' better know what 'U'r doing or 'U'll loose your 'kiddy'!

Me-YOW! POP!

Do you believe another financial crisis is around the corner?

Housing prices falling back to their lowest level since 2002, before the Great Recession began, back-to-back discouraging jobs reports, a slowdown in consumer spending. Take your pick: There's not a lot of rosy news on the economy this week. So much for that whole recovery thing.

Traders work on the floor on the New York Stock Exchange.

Stocks plummeted yesterday on all this news. The Dow Jones Industrials were off more than 2 percent. And the Dow and S&P 500 were down again today.

The big employment report for the month of May comes out tomorrow. Economists are hoping to see 185,000 jobs added. If not, it could be another wild day for the markets.

Talk of a possible double-dip recession is now heating up among economists. And earlier this week, fund manager Mark Mobius told a Foreign Correspondents' Club in Tokyo that another financial crisis is just around the corner because little has changed to regulate what largely caused the first collapse - the derivatives market. New rules to regulate derivatives are scheduled to roll out later this year and others are in the pipeline… but Wall Street-friendly lawmakers are putting up a fight.

This all comes at a time when Washington is trying to figure out how to cut spending in order to lower the deficit... all while playing chicken with the debt ceiling. Moody's Investor Service is threatening to slash the U.S. credit rating if lawmakers do not make significant progress on budget talks by July, out of fear the U.S. could default on its loans. It's going to be a long, hot summer.

|

|

|

|

Post by Hoosier Hillbilly on Jun 3, 2011 16:23:06 GMT -5

Gold 1,542.40 +0.63% :: A picture is worth a 1000 words;  A Double Dip Recession May Be Inevitable A potential double dip recession was a large concern a year and a half ago. There was a belief that the deep economic downturn of 2008 and 2009 could not generate enough momentum for an even modest recovery. Then, the unemployment rate started to fall, car sales began to rebound, same-store retail sales improved, corporate earnings moved higher and fuel prices dropped. The comeback was confirmed by a strong holiday sales season last year and fourth quarter GDP rose 3.1%. Unemployment has fallen below 9% much sooner than most economists believed it would. It has only taken a few weeks, but the chances of a double dip recession have increased. The term is mentioned more often in the media and in speeches by economists. Several large companies have said that their margins and sales may be hurt by inflation. There are a relative small number of reasons that the economy has begun to slow and most of these have worsened quickly. This 24/7 Wall St. analysis looks at each one, explains how its trajectory and momentum has changed this year, and how it could derail the economic recovery Hasn't "OUR" president done a 'wonderful job' with all the concerns of the economy? If ((( he ))) could blotch things any worse 'i' don't know how! He's absolutely out=of-tune with [glow=red,2,300]"REALIZATION"[/glow]He can fly @ our expense wherever & whenever he wishes, whether it's business or { Monkey business } [[ no pun intended ]], but he does have large ears... He is able to give billions to other countries [ & himself ] with no regrets or regards for the "state of matters here in the "US". He expects "US" to bail him out again- OR! "WE" gon'a do it? |

|

|

|

Post by LuLu on Jun 3, 2011 16:44:31 GMT -5

Symbol__________Last__________Change

Dow Jones_________12151.26________-97.29

general electric_________36.79________-0.94

gold__________________81.00_________0.18

caterpillar______________15.53________-0.03

|

|

|

|

Post by LuLu on Jun 6, 2011 12:01:30 GMT -5

Symbol__________Last___________Change

Dow Jones__________12142.33_________-8.93

general electric_________36.02_________-0.77

gold__________________81.37__________0.37

caterpillar_____________15.35_________-0.18

|

|

|

|

Post by LuLu on Jun 7, 2011 10:10:03 GMT -5

Symbol__________Last___________Change

Dow Jones__________12167.15__________77.19

general electric_________36.36___________0.34

gold___________________80.88__________1.16

caterpillar______________15.11__________-0.04

|

|

|

|

Post by Hoosier Hillbilly on Jun 8, 2011 6:27:40 GMT -5

BOTTOMS UP! Stocks DOWN? If 'we' go below 11,500 double dip is only months away. Drastic times requires drastic measures: When a situation has become highly problematic, it is considered appropriate to use corrective action that is considered more extreme than usual. I.E the more severe the situation, the more severe the solution. [glow=red,2,300]

IF[/glow] "OUR" government doesn't get their act together and start acting like mature adults working together for the good of the country there won't be [shadow=red,left,300]any[/shadow] country left to |

|

|

|

Post by LuLu on Jun 8, 2011 13:56:23 GMT -5

Symbol__________Last____________Change

Dow Jones__________12079.55___________8.74

general electric_________35.52__________-1.07

gold__________________76.62__________-3.69

caterpillar_____________15.21___________0.04

|

|

|

|

Post by LuLu on Jun 9, 2011 9:41:40 GMT -5

Symbol__________Last__________Change

Dow Jones___________12118.38_______69.439

general electric__________35.40_______-0.14

gold___________________77.64________0.60

caterpillar______________15.18_______-0.08

|

|